Sundaram Alternates Real Estate Credit Fund-V Hits ₹1,000 Crore Milestone:

Sundaram Alternates Real Estate Credit Fund V Crosses ₹1,000 Crore in 3 Months: Why ESG-Aligned Credit is the New HNI Favorite

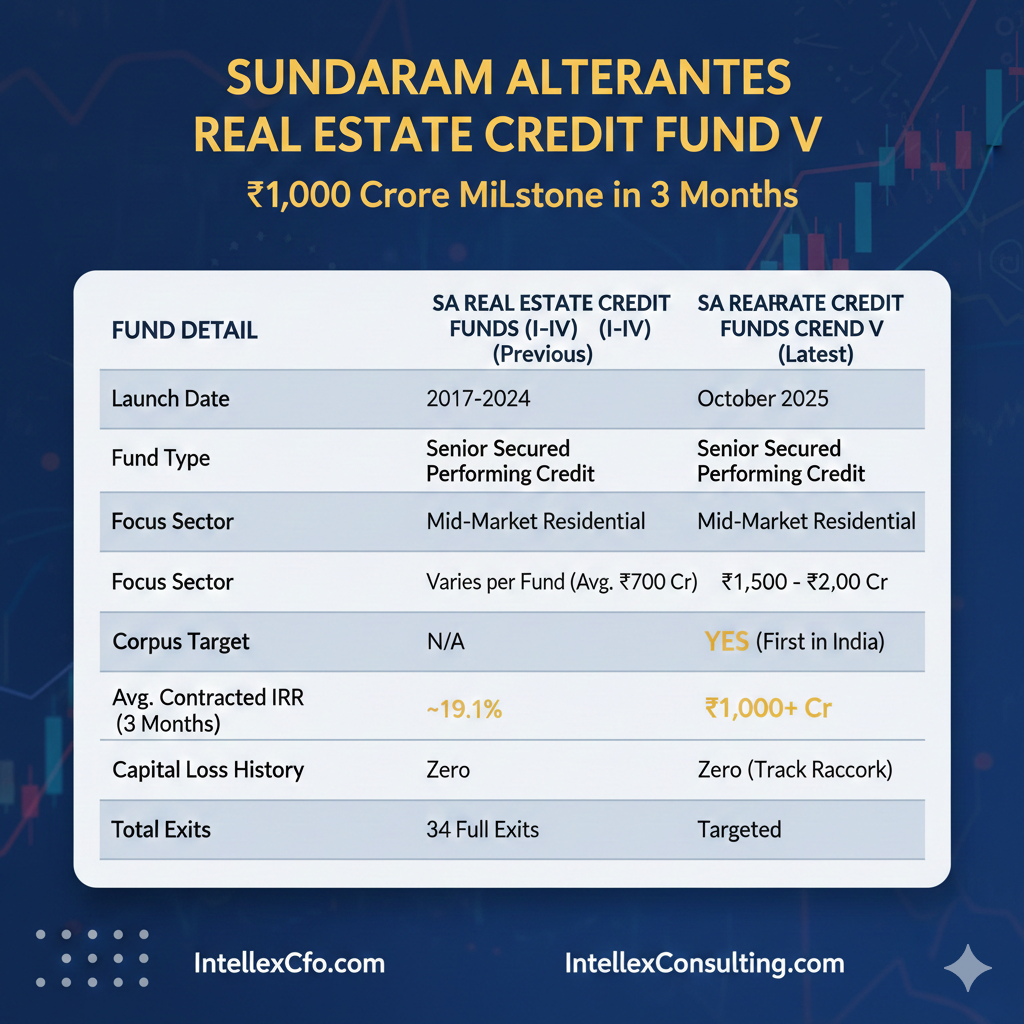

The Indian private credit landscape has witnessed a significant milestone as Sundaram Alternates (SA), the specialist alternative investment arm of the Sundaram Finance Group, announced that its SA Real Estate Credit Fund V has surpassed ₹1,000 crore in capital commitments. Remarkably, this achievement comes within just three months of its launch in October 2025.

As the first ESG-aligned real estate credit fund in India, this fund is setting a new benchmark for institutional and ultra-high-net-worth (UHNW) interest in structured debt.

Also Read:

Funding & Investment Options to Grow India’s Real Estate & Allied Businesses

The Milestone: Rapid Capital Accumulation

Launched in October 2025, the fund has reached the ₹1,000 crore mark with impressive speed, reflecting high investor confidence in the Sundaram brand and the specific strategy of the fifth iteration of their real estate series.

- Target Corpus: ₹1,500 – ₹2,000 crore.

- Fundraising Timeline: Expected final close by March 2026.

- Investor Profile: A diversified mix of insurance companies, family offices, corporate treasuries, and UHNWIs.

- Skin in the Game: The fund includes a significant sponsor commitment from the Sundaram Finance Group, ensuring alignment between the fund manager and investors.

Investment Strategy: Safety First with Yield

The SA Real Estate Credit Fund V follows a performing credit strategy. Unlike “distressed” debt funds, this fund focuses on providing senior secured, amortizing loans to brownfield, cash-generating residential projects.

Key Pillars of the Strategy:

- Senior Secured Position: The fund takes a priority claim on the assets, ensuring that in the event of a default, the fund is the first to be repaid.

- Brownfield Focus: By investing in projects that are already under construction and have demonstrated sales momentum, the fund minimizes “execution risk.”

- Capital Protection: SA utilizes conservative Loan-to-Value (LTV) structures—typically capped around 65-70%—backed by registered mortgages on completed or near-completion inventory.

- ESG Integration: As India’s first ESG-aligned realty credit fund, it integrates environmental (green certifications), social (affordable housing), and governance (transparent reporting) criteria into its underwriting process.

Also Read:

Infrastructure Finance in India: Concept, Evolution, Key Players, and the Road Ahead

Performance Track Record

Sundaram Alternates has built a formidable reputation in the private credit space since 2017. Their track record is a major driver of the current fund’s success:

Metric | Achievement |

|---|---|

Total Raised (RE Credit) | Over ₹3,800 crore across 5 funds |

Total Deployed | ₹4,140 crore across 73 deals |

Average Contracted IRR | 19.1% |

Capital Loss History | Zero capital loss to date |

Exits | 34 full exits totaling ₹1,829 crore |

”Crossing ₹1,000 crore within three months reflects the confidence that investors place in our underwriting discipline and risk framework,” said Karthik Athreya, Managing Director, Sundaram Alternates.

Why Real Estate Credit is Booming in 2026

The success of Fund V is not an isolated event but a reflection of broader market dynamics in the Indian economy:

- Bank Retrenchment: Traditional banks remain selective in lending to developers, leaving a “funding gap” that AIFs (Alternative Investment Funds) are perfectly positioned to fill.

- Residential Demand: With the Indian real estate sector projected to reach $1 trillion by 2030, the demand for mid-market housing in Tier-1 and Tier-2 cities remains resilient.

- The “Search for Yield”: In a volatile equity market, fixed-income alternatives that offer 18-20% IRR with strong collateral backing are highly attractive to sophisticated investors.

Conclusion for Investors

The SA Real Estate Credit Fund V represents a sophisticated evolution of the Indian AIF market. By combining the safety of senior secured debt with the growing necessity of ESG compliance, Sundaram Alternates has created a vehicle that appeals to the modern, conscious, and risk-averse institutional investor.

For those looking to diversify away from traditional equity or low-yield fixed deposits, the private credit space specifically through established managers like Sundaram continues to offer a compelling risk-adjusted proposition.

Team: IntellexCFO.com

More Featured Articles:

How Ex-Bankers Can Build a High-Income Second Career Through a Corporate DSA Partner Program

SME IPO in India 2025: Complete Guide for Investors & Growing Businesses

Building Future Leaders: The Birla Open Minds School Franchise Opportunity

Strategic Finance Options for Medical and Hospital Businesses in India (2026)

Hyderabad Angel Fund Launches Rs 100 Crore Fund to Support High-Potential Startups in India