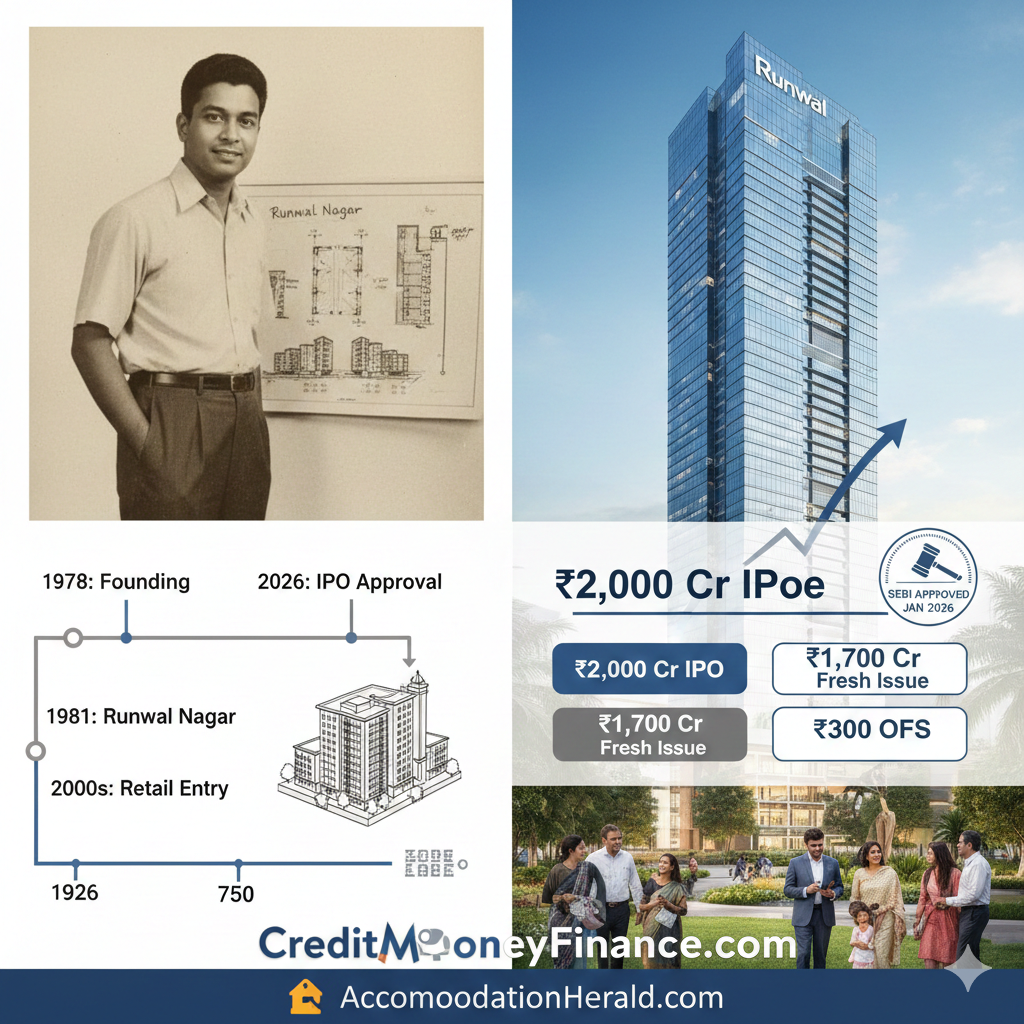

Runwal Developers IPO 2026: A Deep Dive into the ₹2,000 Crore Public Issue and the Legacy of a Mumbai Real Estate Titan

Runwal Developers IPO 2026: A Deep Dive into the ₹2,000 Crore Public Issue and the Legacy of a Mumbai Real Estate Titan Explore the comprehensive journey of Runwal Developers IPO as they receive SEBI approval for their ₹2,000 Crore IPO in January 2026. Discover the history, landmark projects like R City Mall, and the future […]