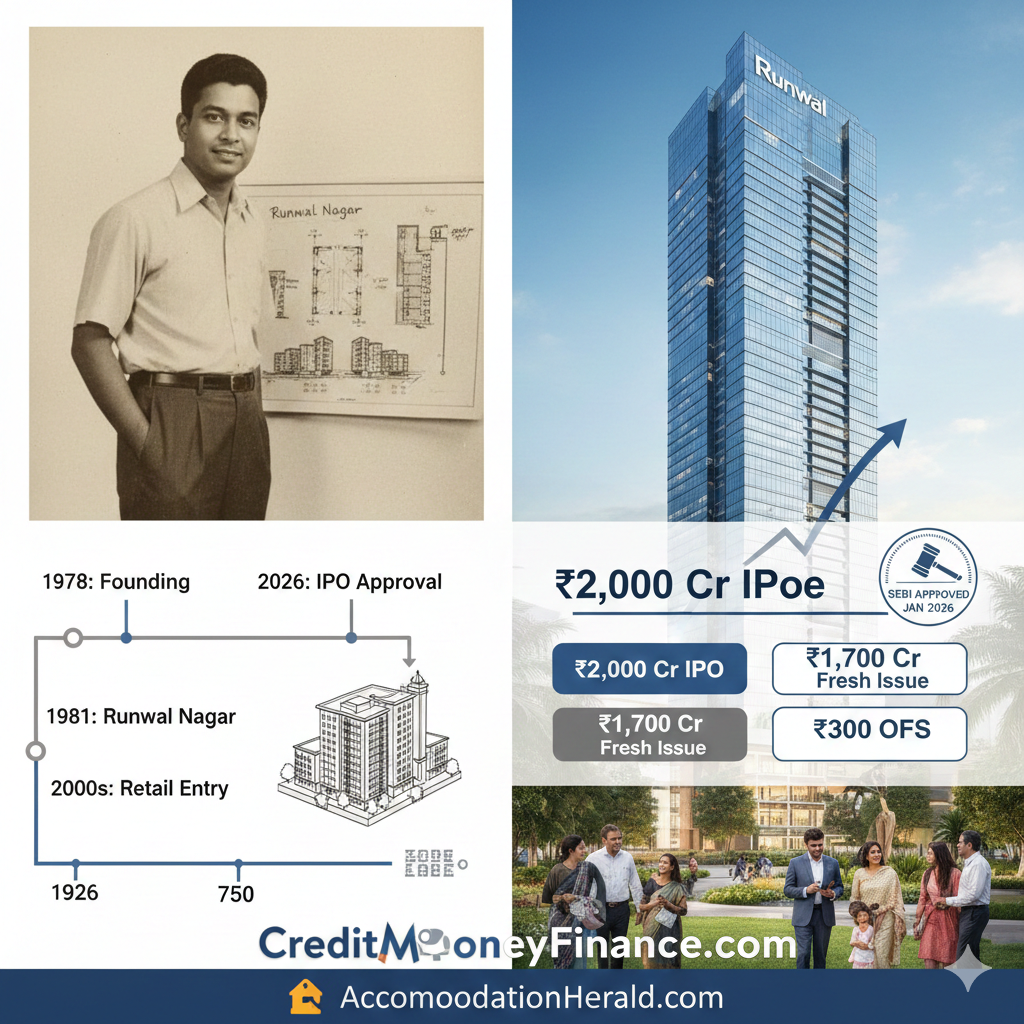

Runwal Developers IPO 2026: A Deep Dive into the ₹2,000 Crore Public Issue and the Legacy of a Mumbai Real Estate Titan

Explore the comprehensive journey of Runwal Developers IPO as they receive SEBI approval for their ₹2,000 Crore IPO in January 2026.

Discover the history, landmark projects like R City Mall, and the future outlook of this Mumbai real estate giant and their upcoming IPO.

The Indian primary market has hit the ground running in 2026. Among the most anticipated market debuts is Runwal Developers Limited (often associated with the broader Runwal Group), which officially received the nod from the Securities and Exchange Board of India (SEBI) in mid-January 2026 to launch its Initial Public Offering (IPO).

As one of the most recognizable names in the Mumbai Metropolitan Region (MMR), the Runwal IPO is not just a financial event; it is a milestone for a brand that has spent over four decades shaping the skyline of India’s financial capital.

Also Read: Family Office Investments in India: Fueling Startups, Scaleups & Growth-Stage Enterprises

The IPO Snapshot: Key Figures and Structure

The Runwal Developers IPO is structured to balance aggressive growth with promoter liquidity. Based on the Draft Red Herring Prospectus (DRHP) and the recent SEBI observations, here are the essential details:

- Total Issue Size: Approximately ₹2,000 Crore (₹20 billion).

- Fresh Issue Component: ₹1,700 Crore. These funds are earmarked for the company’s expansion, debt reduction, and the acquisition of new land parcels to fuel its “Future-Ready” pipeline.

- Offer-for-Sale (OFS): ₹300 Crore. This portion involves a secondary sale of shares by the promoter, Sandeep Subhash Runwal, allowing the founding family to partially divest their stake while remaining firmly at the helm.

- Face Value: ₹1 per equity share.

- Listing Destinations: The shares are proposed to be listed on both the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

- Lead Managers: Financial heavyweights like ICICI Securities and Jefferies are typically involved in spearheading issues of this magnitude.

The Beginning: From a Young Accountant to a Property Tycoon

To understand the value of the Runwal brand, one must look back to 1978. The story of the Runwal Group is a classic “rags-to-riches” saga of its founder, Mr. Subhash S. Runwal.

Born in Dhulia, Maharashtra, Subhash Runwal moved to Mumbai at the age of 21 with less than ₹100 in his pocket. A Chartered Accountant by profession, he worked for nearly a decade in the corporate sector before identifying a massive gap in the Mumbai housing market: affordable, high-quality homes for the middle class.

The 1980s: Laying the Foundation

The group’s first major breakthrough was Runwal Nagar in Thane, a cluster of 16 buildings constructed in 1981. This project established the brand’s reputation for timely delivery and transparency traits that were rare in the unorganized real estate sector of that era. Subhash Runwal’s ability to navigate the complex land laws (such as the now-repealed Urban Land Ceiling Act) allowed the group to secure strategic land parcels early on.

Past Milestones: Redefining the “R” Brand

Over the last 45+ years, Runwal has evolved from a suburban residential builder into a diversified real estate conglomerate.

1. Diversification into Retail

One of the most significant moves in the company’s history was its entry into the Organized Retail space.

- R City Mall (Ghatkopar): Spanning over 1.2 million square feet, it is one of Mumbai’s largest and most successful shopping destinations.

- R Mall (Mulund & Thane): These projects turned the group into a dominant player in the retail-led mixed-use development sector.

2. Strategic Partnerships

The group’s credibility is underscored by its ability to attract global capital. It has historically partnered with institutional investors like GIC (Singapore’s Sovereign Wealth Fund) and Warburg Pincus for its retail and residential platforms, showcasing a high level of corporate governance and professional management.

3. Residential Dominance

With over 65 delivered projects and a footprint covering luxury, premium, and large-format townships, Runwal has served more than 35,000 families. Notable landmarks include:

- Runwal Bliss (Kanjurmarg): A premium township designed around an ancient Banyan tree.

- Runwal Forests (Kanjurmarg): A massive forest-themed luxury development.

- Runwal Gardens (Dombivli): An 115-acre integrated township.

Also Read: Infrastructure Finance in India: Concept, Evolution, Key Players, and the Road Ahead

Current Business Outlook: A Market Leader in MMR

As of early 2026, Runwal Developers stands as a Top 10 Developer in the MMR region. Their current business strategy is built on three pillars:

A. Dominance in the “Central Suburbs” and “Thane”

Runwal has an almost unrivaled inventory and land bank in the high-growth corridors of Kanjurmarg, Mulund, and Thane. These areas have seen the highest appreciation in property values due to improved metro connectivity.

B. High-Yield Commercial Assets

Beyond residential sales, the group maintains a robust portfolio of leased assets. This provides a steady stream of recurring rental income, which is a major attraction for IPO investors looking for a “de-risked” real estate model.

C. Financial Health

The decision to go public with a ₹1,700 Crore Fresh Issue suggests a move toward a “Net Debt Zero” or “Asset-Light” strategy. By paying down high-cost debt and using the remaining funds for construction, the company aims to improve its Return on Equity (RoE) and PAT Margins, which stood at approximately 55% in previous fiscal disclosures (though consolidated figures vary by entity).

Future Outlook: The “Runwal 2.0” Strategy

What does the future hold for Runwal Developers post-listing?

1. Expansion into New Geographies

While Mumbai remains the core, the group is looking at scaling its presence in Pune and potentially exploring other Tier-1 cities. The IPO proceeds will provide the “war chest” needed for these acquisitions.

2. Focus on “Integrated Townships”

The future of Indian urban living is moving toward self-contained ecosystems. Runwal’s focus on Mixed-use Developments (Live-Work-Play) will see them integrating more co-working spaces, healthcare facilities, and international schools within their residential complexes.

3. Technological Integration

The group is increasingly adopting PropTech—using AI for construction management and digital twins for facility management—to reduce “Time to Market” and enhance the customer experience.

4. Sustainability and ESG

With the global shift toward green building, Runwal is prioritizing ESG (Environmental, Social, and Governance) frameworks. This is crucial for attracting Foreign Institutional Investors (FIIs) who will be looking for sustainable practices in the 2026-2030 real estate cycle.

Also Read: Funding & Investment Options to Grow India’s Real Estate & Allied Businesses

Conclusion: Is the Runwal IPO a Game Changer?

The Runwal Developers IPO represents a significant shift for a legacy family-run business transitioning into a publicly-traded entity. For investors, it offers a rare opportunity to own a piece of the Mumbai Growth Story. With a massive ₹2,000 Crore issue size, the company is clearly positioning itself to compete with industry giants like Macrotech (Lodha) and Godrej Properties.

The combination of a strong legacy, massive retail assets, and a focused residential pipeline makes this one of the most compelling real estate stories of 2026.

Team: Accommodationherald.com

More Featured Articles:

How Ex-Bankers Can Build a High-Income Second Career Through a Corporate DSA Partner Program

Strategic Finance Options for Medical and Hospital Businesses in India (2026)

Smart Funding Solutions for Every Business Need — Powered by GrowMoreLoans.com

SME IPO in India 2025: Complete Guide for Investors & Growing Businesses

Unsecured CGTMSE MSME Loans from Leading Government Banks Exclusively for Self-Employed Individuals

Working Capital Solutions for Growing Businesses across India from Banks and NBFC