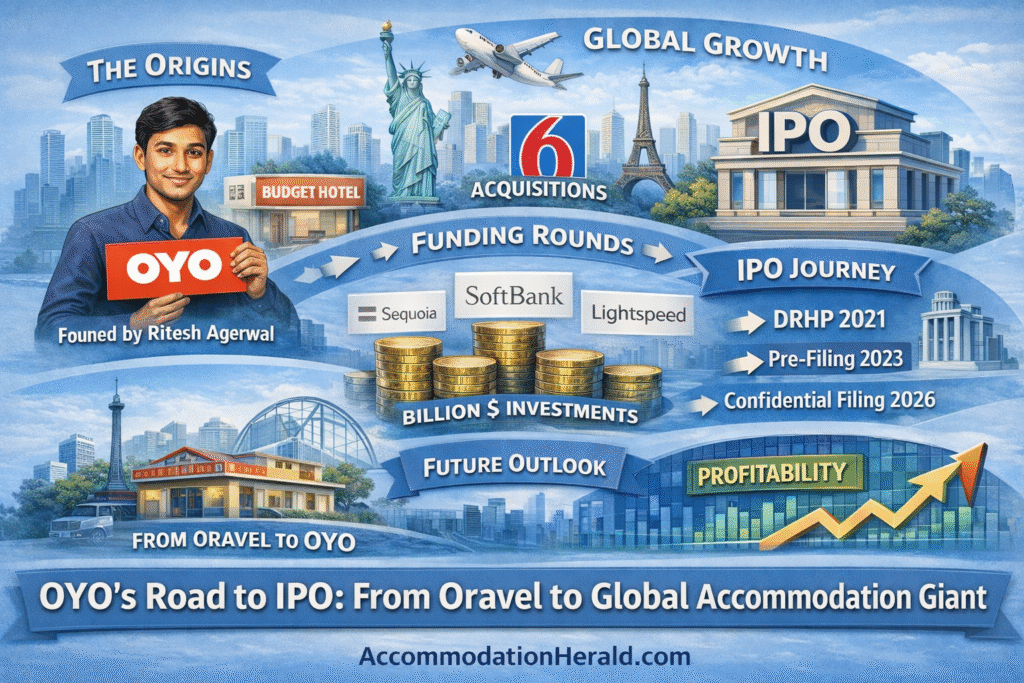

OYO IPO Watch: From Oravel to PRISM – Origin Story, Hypergrowth, Funding Rounds, Current Financial Turnaround, and What’s Next.

OYO’s IPO is back on the table. Track its founding, rapid scale-up, key funding rounds, profitability pivot, IPO filings, and 2026 outlook.

OYO (operated by Oravel Stays; parent brand / holding entity now associated with PRISM) is one of India’s most recognized hospitality-tech stories: a company that tried to standardize budget stays at scale, expanded globally, stumbled during the post-hypergrowth years, and then worked its way back toward profitability while repeatedly testing the public markets.

As of late 2025 / early 2026, OYO’s IPO conversation has reignited again, with reports that its parent PRISM has filed confidential IPO papers with SEBI for a ₹6,650 crore public issue and is targeting a valuation in the $7–8 billion range.

Also Read:

Funding & Investment Options to Grow India’s Real Estate & Allied Businesses

1) Company start: from Oravel Stays to “OYO”

2012: Oravel Stays:

Ritesh Agarwal began with Oravel Stays as a budget accommodation listing and booking platform, before repositioning the model toward standardization and branding.

2013 onward: OYO’s core idea

OYO’s early promise was simple: budget hotels were fragmented, inconsistent, and often unreliable. OYO would impose a minimum standard (rooms, linens, basic amenities, service expectations), help owners lift occupancy, and use technology and distribution to scale demand.

Over time, OYO evolved from “aggregator” to a mix of franchise and management contracts, branded storefront distribution, and increasingly a travel-tech platform play.

The company’s narrative shifted in stages: growth-first, then consolidation, and more recently, a push for unit economics and profitability.

2) Growth story: how OYO scaled so fast and why it later had to reset:

The hypergrowth playbook

OYO’s early expansion was powered by:

Asset-light scaling partnering with existing hotel owners rather than owning real estate,

Brand standardization and predictable customer experience,

Centralized distribution (app + web + OTA partnerships, plus B2B channels),

Dynamic pricing and demand management and data-driven occupancy optimization,

This model can scale extremely fast in a supply-fragmented market like India and it did.

The messy middle: profitability pressure and portfolio cleanup

Hypergrowth hospitality isn’t free.

Standardization requires enforcement, owner incentives, customer support, refunds, and often heavy discounting to build demand. When the market cycle turned (especially around COVID-era disruptions), the company had to pull back, reduce loss-making inventory, renegotiate partner terms, and focus more tightly on margins.

A visible marker of this reset is the company’s later emphasis on EBITDA positivity and reported profitability improvements.

3) OYO funding rounds: the capital that built the giant.

OYO’s rise sits squarely in the “venture and growth equity” era of Indian consumer internet. The investor roster has included SoftBank, Sequoia, Lightspeed, and others over time.

2015: Early growth capital.

Reports of $25M from investors including Lightspeed and Sequoia-era ecosystem coverage

Fueled India expansion playbook

2015–2016: Large SoftBank-led infusion. Widely reported $100M SoftBank involvement .

This Validated scale thesis, accelerated supply acquisition

2018 : Mega round – OYO raised $800M led by SoftBank Vision Fund, with additional commitment discussed in the same period

This funding unlocked global ambition and elevated “unicorn” narrative

2019: Strategic capital and secondary activity: Funding and investor activity included Didi and broader late-stage participation; valuation headlines reached $10B in coverage and

Consolidated cap table dynamics, founder stake narratives

2019: Series F scale financing – Reports of $1.5B financing with founder participation structure. This reinforced war chest, but raised long-term profitability expectations.

2021 : Debt financing – Reported $660M debt financing round

Refinancing and supporting expansion needs.

2024–2025 : Turnaround narrative and selective expansion – More focus on operating metrics and acquisitions rather than “funding as growth”.

The SoftBank factor – SoftBank has been central to OYO’s scale story and also central to IPO timing, conversations.

Also Read:

SME IPO in India 2025: Complete Guide for Investors & Growing Businesses

4) IPO journey: multiple attempts, now a confidential filing again:

OYO’s IPO is not a single event , it’s a multi-year process shaped by markets, financial performance, and investor alignment.

Attempt 1: The 2021 DRHP filing

OYO first filed a DRHP in September 2021, with reports noting an IPO size around ₹8,430 crore at the time.

Attempt 2: Updates and the “confidential” route (2023) – In March 2023, coverage indicated OYO pre-filed via a confidential route for a smaller IPO after SEBI asked for updates to disclosures and financials in the prior cycle.

Attempt 3: Late 2025 / early 2026 – PRISM files again

The newest development: reports indicate OYO’s parent PRISM has submitted IPO papers through SEBI’s confidential filing route, seeking to raise ₹6,650 crore and aiming for a valuation around $7–8 billion.

This matters because the confidential route allows companies to keep sensitive IPO details private until later stages useful for volatile markets and for businesses that want flexibility on timing.

Shareholder approval (a key governance step)- It is reported that PRISM secured shareholder approval to raise up to 66.50 billion rupees (₹6,650 crore) via a new equity issuance as part of the proposed IPO process.

5) Current status: profitability signals, scale moves, and strategic acquisitions:

A credible IPO case in 2026 depends on a single question: Is OYO now a durable, profitable travel-tech business or a cyclical hospitality aggregator?

Profitability turning point: FY24

In May 2024, multiple reports cited OYO’s claim of its first profitable full year in FY24, with profit after tax around ₹100 crore.

FY25: Revenue growth and net profit reported

Reuters reported that for FY25, PRISM recorded a 16% revenue increase to 62.53 billion rupees and a 6.6% rise in net profit to 2.45 billion rupees.

The Motel 6 / G6 Hospitality acquisition: OYO goes deeper in the U.S.

One of the most important strategic milestones was OYO’s acquisition of G6 Hospitality (parent of Motel 6 and Studio 6) from Blackstone in an all-cash deal of $525 million, completed in December 2024.

Why this matters for IPO investors:

Motel 6 is a globally recognized budget lodging brand in the U.S.

Franchising economics can be attractive if managed well.

It strengthens OYO’s “international revenue” story and diversifies geographic exposure.

6) Key risks investors will scrutinize in the IPO:

No OYO IPO story is complete without the risks that will sit in the “Risk Factors” section of the prospectus.

1) Cyclicality of travel and pricing pressure

Hospitality demand is cyclical. Even if OYO positions as travel-tech, a meaningful share of economics still links to occupancy, ADR trends, and travel sentiment.

2) Partner quality and brand consistency

OYO’s model depends on hotel partners adhering to standards. Any quality slippage can hit ratings, refunds, and brand trust.

3) Litigation and legacy disputes

OYO has faced disputes historically (for example, the long-running Zostel/Zo Rooms matter is widely documented in public sources).

4) Shareholder alignment and valuation expectations

Reuters has highlighted how valuation expectations have shifted from earlier cycles to the current reported target range. This can influence IPO pricing, anchor demand, and post-listing performance.

5) Integration risk: Motel 6 and international complexity

Cross-border integration is hard: systems, brand management, franchise relations, and cost discipline must all stay tight for the acquisition to add shareholder value.

Also Read:

Infrastructure Finance in India: Concept, Evolution, Key Players, and the Road Ahead

7) Future outlook (2026 and beyond): what could go right and what could break.

The bull case: a scaled, profitable hospitality platform:

If OYO sustains profitability and builds a stable, repeatable model, the IPO thesis strengthens around:

Operating leverage (tech and distribution costs grow slower than revenue)

Premiumization (higher contribution margins from better properties and longer stays)

International diversification (especially with U.S. franchising economics via Motel 6/Studio 6)

Multiple engines: hotels, vacation homes, and adjacent offerings (selective acquisitions in global markets have been reported)

The base case: steady but valuation-sensitive.

In a more neutral scenario, OYO lists at a valuation that reflects:

Moderate growth

Improving margins

Clearer governance and disclosures

But faces pressure if broader tech IPO sentiment weakens or if travel demand softens.

The bear case: growth stalls or quality issues resurface:

The downside scenario looks like:

Weak travel cycle + price wars

Rising customer acquisition costs

Partner churn and inconsistent inventory quality

Acquisition integration challenges

In that case, the market may compress the multiple and punish the stock post-listing.

8) What to watch next :

If you’re tracking OYO as a potential IPO candidate in 2026, these are the milestones that matter most:

SEBI feedback and next steps on the confidential filing (timelines can vary).

Updated financial disclosures: revenue mix, contribution margins, adjusted EBITDA reconciliation, and cash flow.

Motel 6 integration metrics: franchise growth, RevPAR trends, direct bookings, and brand KPIs.

Unit economics clarity: how much profit per booking/property after incentives, refunds, and support costs.

Cap table and selling shareholder intentions: whether the IPO is largely fresh issue, OFS-heavy, or mixed.

Closing take: OYO’s IPO is less about “growth” now more about “quality of earnings”

OYO’s early identity was built on expansion at breakneck speed. The next chapter is different. With PRISM’s reported confidential filing for a ₹6,650 crore IPO and a valuation target of $7–8 billion, the market is being asked to underwrite a business that claims it has crossed the hardest bridge: from scale to sustained profitability.

Whether the IPO becomes a breakout listing or a valuation tug-of-war will hinge on transparent financials, consistent property standards, and proof that the post-turnaround OYO can grow without relapsing into discount-led expansion.

Team: Accommodation Herald

More Featured Articles:

Family Office Investments in India: Fueling Startups, Scaleups & Growth-Stage Enterprises

Real Estate Debt & Equity AIFs: The New Wealth Strategy for Indian High Net Worth Investors

Building Future Leaders: The Birla Open Minds School Franchise Opportunity